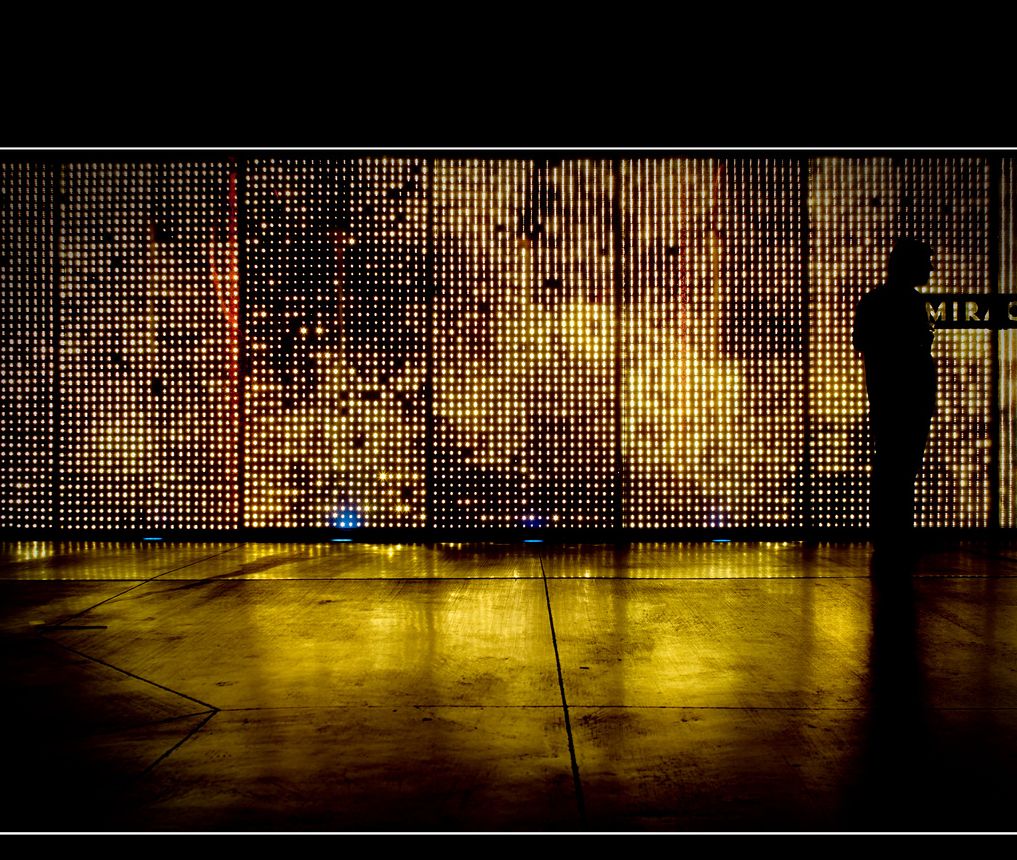

Walk into any modern space — a mall, an office lobby, a transit hub, even a stadium concourse — and it’s hard not to notice the sheer ubiquity of LED displays. What was once a technology reserved for flashy billboards or niche event signage is now woven into the very fabric of how people experience places. The LED display market isn’t just growing; it’s changing its shape, its priorities, and its expectations.

A recent comparative analysis of the LED display market transformation between 2026 and 2033 highlights trends that aren’t just about bigger, brighter screens. They’re about how these screens are deployed, where the value actually lies, and why growth is shifting into areas that once felt marginal.

The numbers matter — demand curves, CAGR percentages, regional growth forecasts — but the underlying story is cultural and spatial. It’s about how spaces, brands, and people are negotiating attention in a world where screens are everywhere yet attention remains finite.

The Market Is Maturing, Not Exploding

There was a period not long ago when the narrative around LED displays was essentially “bigger is better.” Outdoor walls that could be seen from highways. Stadium displays that swallowed entire façades. Ultra-large installations that defined skylines. Those projects were spectacular, but they were also exceptions: location-specific, budget-heavy, and often more about presence than performance.

What’s happening now is less about spectacle and more about utility and integration. Growth isn’t just coming from outsized outdoor screens. It’s coming from tighter pixel pitches, indoor displays, modular systems, control networks, and UX-oriented installations that serve function as much as form. The market isn’t just bigger — it’s expanding in dimension and intent.

That’s the shift analysts are trying to capture in their models. By 2033, while high-impact outdoor LED walls will still exist and still turn heads, a lot of growth will come from places people live and work: retail environments, corporate campuses, airports, transit hubs, education centers, immersive branded spaces, and experiential retail.

Fine Pitch, Indoor, Integrated — Where the Real Growth Lies

The more interesting trend isn’t who’s spending more — it’s where they’re spending. Pixel pitch, once a niche specification read only by AV nerds, is now a defining term for designers and planners. Sub-2mm pitch, micro-LED surfaces indoors, and integrated modular panels are driving demand in places that used to depend on projectors or static signage.

This has two implications. First, the viewing distance is now a design concern. In an office lobby, people stand two meters from a wall. On a street, they might be 30 meters away. The expectations for resolution, color consistency, and visual coherence are completely different. A stadium can get away with coarse pitch; a boardroom demands fine pitch.

Second, indoor installations are happening within ecosystems, not in isolation. They need to interact with lighting design, ambient sound, occupancy sensors, UX flows, wayfinding, and content strategy. The growth shift towards indoor LED is as much about experience design as it is about hardware proliferation.

Modularity and Serviceability Are Now Market Drivers

One of the subtler but more consequential shifts is towards modular and serviceable systems. In older models of LED deployment, walls were often treated as monoliths. If one section failed, you replaced a big chunk of the wall. That’s expensive, wasteful, and disruptive.

Modular designs change the economics. Serviceable panels make maintenance predictable and discrete. A failed module can be swapped by a technician in minutes rather than hours. For multi-year installations, that matters. Budgets, operational continuity, and lifecycle planning all improve when displays are repairable rather than disposable.

This is one of the reasons growth is shifting indoors. Outdoor walls still get budgets — but indoor applications tend to demand longevity and uptime. Buildings are constructed to last decades; a screen that becomes dated or unserviceable in a few years undermines that investment. Modularity aligns with long-term thinking, and that’s why procurement teams are starting to insist on it.

Content Strategy Is Part of the Market Now

Economists talk about supply and demand. Designers talk about context and content. As LED screens move into everyday environments, what is shown matters as much as where the screens sit. The analysis points to this, implicitly: LED installations aren’t just hardware purchases anymore. They’re platforms.

Look at any big airport terminal with LED wayfinding and you see why. These displays don’t just show directions. They react to crowd flow, they adapt to schedule changes, they elevate or simplify based on context. In retail, an LED wall may show brand messaging, adaptive promotions, or live social feeds. In corporate lobbies, they’re used for everything from internal culture messaging to live dashboards.

What this means is that content strategy — something often outsourced or underfunded — has become an integral part of the LED ecosystem. LED displays aren’t just screens; they’re communication platforms. The installations that will last, and the markets that will grow fastest, are the ones that leverage content intelligently — not just broadcast motion graphics but curate context.

Regional Shifts and Market Dynamics

Asia-Pacific still dominates a lot of the headline growth figures — massive installations in China, Korea, and Japan continue to push scale and bold design. But the comparative analysis suggests something else: regional diversification. Europe and North America aren’t mere followers; they’re optimizing different applications.

In China, LED often takes the form of urban canvases — façades of buildings, public squares, megacity visual identity. In North America and Europe, much of the growth is happening behind the façade — indoor video walls, experiential retail, transit integration, corporate communication. It’s a geographic difference in intent, not intensity.

And that matters because it changes what customers expect. A European airport authority doesn’t buy an LED wall to be seen from space. They buy it to improve passenger flow, reduce confusion, and enhance wayfinding. A retailer in Toronto installs an LED wall to contextualize brand experience, not just show ads. These expectations shape procurement, design briefs, and ultimately, market growth.

Use Cases That Redefine Value

The biggest shift isn’t just more screens — it’s different screens in new roles. Sports arenas still install huge scoreboards, but the next generation of revenue is in fan engagement walls, queuing displays, and interactive fan zones. Transit systems no longer put static timetables on walls; they install screens that integrate real-time data, crowd analytics, and local information.

Corporate environments are becoming surprising adopters. LED video walls are integrated into boardrooms, collaboration spaces, and even wellness areas. They’re no longer just for show — they’re functional surfaces. And as these everyday applications mature, they create volumes of demand that rival, and in some cases exceed, the iconic outdoor walls of yesteryear.

Tech and Perception

One of the more interesting tensions in the market transformation is between technical capability and human perception. You can have ultra-fine pixel pitch and ultra-high brightness, but that’s useless if color uniformity is off or if refresh rates cause flicker during camera capture. LED displays aren’t just boxes with diodes; they are optical experiences.

As screens become more integrated into lived environments, designers are demanding quality that holds up under different lighting conditions, viewing angles, and use cases. A corporate lobby wall has different perceptual needs than a stadium screen, but both require confidence in color, motion, and consistency. The market is waking up to the fact that technical specs matter only in relation to human experience. That’s a hard lesson and one that separates thoughtful deployments from mere visual spectacle.

Challenges Still Ahead

None of this is without friction. Supply chain issues, global component volatility, and skills gaps in installation and calibration still complicate growth. The market is expanding, but the workforce that supports it isn’t always keeping pace. Sophisticated LED systems require careful calibration, thermal management, content strategy, and long-term service plans.

And while the analysis looks forward to 2033 with rosy curves, the truth is that not every customer or project team expects the complexity behind the screens. Many still treat LED like a commodity. That’s a mismatch between expectation and reality that will slow adoption in some sectors until the conversation becomes less about size and more about integration, sustainability, and lifecycle cost.

Observing the Transformation

The LED display market isn’t just bigger. It’s qualitatively different. It’s not just outdoor size pushing revenue; it’s indoor intelligence, modular serviceability, content platforms, and experience design. It’s screens that exist not as objects in space but as participants in the space.

That’s why the projections between 2026 and 2033 aren’t merely about volume. They’re about scope. LED displays are no longer a gimmick. They aren’t just attention magnets. They are tools for communication, experience, wayfinding, revenue generation, and spatial design.

What customers should expect — and what designers and planners are increasingly demanding — isn’t just bigger walls. It’s walls that work, walls that align with human perception, walls that respond to context, and walls that are maintainable over time.

The market is larger not because it’s louder, but because it’s smarter. And as the screens themselves become more embedded in the fabric of everyday spaces, the definition of what we expect from LED technology continues to expand.