There’s a certain irony in discussing LED display market size when the technology itself is about perception. LED displays are designed to disappear into experience. They draw attention, but not to themselves—they are about what they show. And yet here we are: an $8.1 billion market. The number is large, but it’s the scale and scope of adoption that matters more than the dollars.

LED displays have moved beyond niche applications. They are everywhere, from Times Square to shopping malls in Shenzhen, from stadium scoreboards to corporate lobbies. They are embedded in retail, transportation, entertainment, and even education. This ubiquity isn’t accidental; it reflects both technological evolution and a global appetite for flexible, high-impact visual solutions.

The Market Beyond Numbers

When analysts cite $8.1 billion, it’s easy to fixate on the growth curve. Year-over-year percentages, CAGR projections, regional shares—they make good slides but tell only part of the story. What drives this LED display market is more organic: the ways people and organizations want to communicate visually. LED displays allow for scale, brightness, interactivity, and dynamic messaging in ways that LCDs or projection systems cannot.

Consider retail. LED walls are no longer just signage; they are environments. They define spaces. A boutique in Shanghai might use a 4K LED wall as an entire window, animating textures and patterns in sync with store branding. It is no longer about selling a product—it is about curating an experience. Those installations are expensive, but they are also persuasive, and that’s what fuels demand.

Regional Adoption Patterns

Asia-Pacific dominates the LED display market, particularly China, South Korea, and Japan. Massive urban installations in China alone—entire streetscapes illuminated with LED façades—drive market volume in ways no single luxury consumer project could. In contrast, North America and Europe are more measured, using LED for stadiums, corporate offices, and high-profile retail. Each region reflects different priorities: in some, the emphasis is spectacle; in others, utility and ROI.

The $8.1 billion figure also reflects maturation. Early adoption favored novelty; now adoption favors functionality. Companies are not buying LED walls just because they look impressive—they want solutions that scale, that integrate with content management systems, that can be repurposed across locations. The market grows not because everyone wants an LED screen, but because the screens themselves are more capable, modular, and adaptable than ever.

Technological Drivers

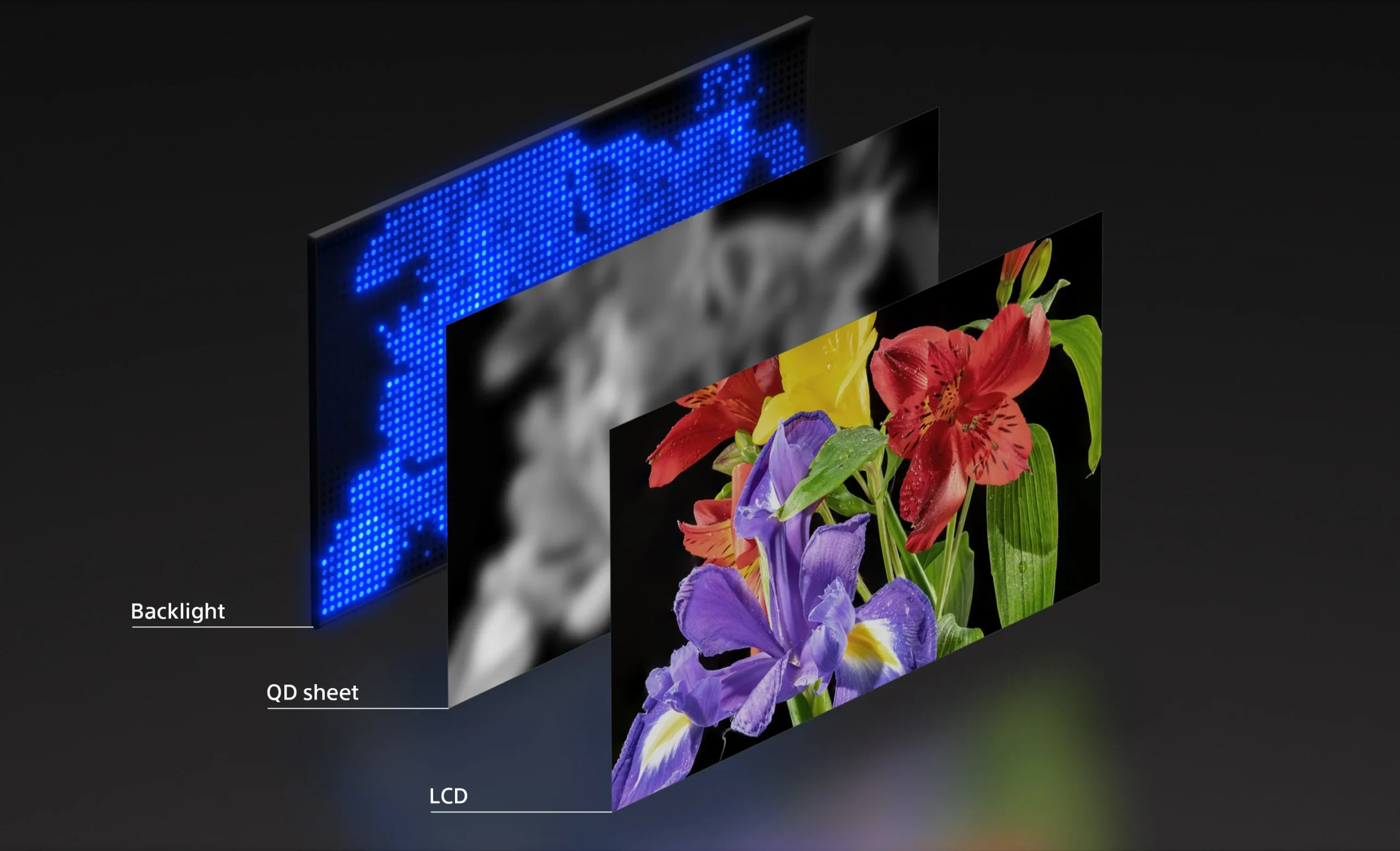

Behind the numbers lies technology. Smaller pixel pitch, higher refresh rates, improved brightness, and longer lifespans make LED displays more compelling. Micro LED and fine-pitch LED are pushing the envelope, enabling ultra-high-resolution surfaces suitable for close-view applications. Even digital signage that once required projectors can now use direct-view LED.

Color fidelity is no longer negotiable. Architects and designers care about uniformity, contrast, and saturation. The human eye notices subtle deviations, especially on large-scale or multi-panel installations. When LEDs can deliver consistent color across hundreds or thousands of square feet, the market shifts from early adopters to serious institutional buyers—museums, corporate lobbies, stadiums. That’s how market size grows: when capability meets real-world demand.

Commercial versus Experiential

Not all revenue comes from flashy façades or stadium installations. Corporate communications, control rooms, transportation hubs, and experiential retail form a substantial part of the market. Airports in Dubai or Beijing use LED displays for wayfinding and flight information. Stock exchanges rely on LED tickers. Control rooms for energy grids, security, and transportation depend on LED walls for clarity and reliability.

This mix explains why analysts project continued growth. The technology is not tied solely to consumer attention or aesthetic trends—it is functionally valuable. Every corporate lobby or public space that upgrades from LCD to LED adds incremental revenue. Multiply that across continents, and the cumulative market becomes massive.

Modular Design and Scalability

Part of the LED display market growth comes from modularity. LED panels can be stitched into walls, ceilings, floors, or façades of arbitrary size. Pixel pitch is decreasing, panel sizes are increasing, and software ecosystems are improving. Clients can start with a 2×2 meter wall and scale to dozens of meters with minimal additional hardware complexity.

Designers and architects respond to that flexibility. LED surfaces can wrap corners, occupy unconventional geometries, or even integrate into furniture. The installation itself becomes part of the environment, not just an overlay. The more seamlessly LEDs integrate into built spaces, the higher the adoption rate—and the faster the LED display market expands.

Durability and Lifecycle Economics

Another driver often overlooked is longevity. LED displays outperform traditional technologies in lifespan, maintenance intervals, and robustness. Even in urban outdoor conditions—high UV, rain, snow, dust—modern LEDs maintain brightness and color uniformity for years. Lifecycle economics become a selling point. Initial investment may be high, but the predictable maintenance cycle makes budgeting easier, and that certainty attracts institutional buyers.

Long-term adoption is the unsung component of market size. Early adopter hype generates attention, but sustained deployment drives billions in revenue. LED displays are no longer novelties; they are infrastructure. They are durable investments, not marketing experiments.

Interactive and Programmatic Content

The LED display market is also growing because LEDs enable programmatic and interactive content. Event organizers, museums, and retailers are exploring dynamic surfaces: walls that respond to proximity, sound, or touch; façades that change with social media feeds; stadium boards that integrate live statistics in real time.

This interactivity expands applications and monetization models. A display is no longer just a screen—it is a platform. Clients pay for content management systems, creative services, and real-time integration. Each layer contributes to market size. The growth of software and service revenue alongside hardware revenue explains why analysts see sustained expansion.

Observing Market Psychology

Numbers like $8.1 billion can obscure the human story. People see a wall of LEDs and feel something—attention, delight, awe. Businesses see that reaction and want to capture it. It’s a cycle: technology enables impact, impact drives adoption, adoption drives investment, and investment funds better technology. That feedback loop is at the heart of market growth.

Designers have noticed, too. LED displays are no longer an afterthought. They influence architecture, spatial planning, and visual hierarchy. The market’s expansion is partly a reflection of how seriously the design community now treats the medium. If a lobby or plaza can command attention with LEDs, it becomes central to the client brief, not peripheral.

Market Risks and Considerations

Of course, the market isn’t infinite. Energy consumption, regulatory constraints, visual fatigue, and urban planning concerns could temper adoption in certain regions. Over-saturation might lead to diminishing returns in terms of human attention. Designers are acutely aware that an overly bright façade can generate complaints, and municipalities increasingly regulate luminous intensity.

But for now, demand continues to outpace constraint. As LED technology improves, integration becomes easier, and buyers understand lifecycle costs better, the market expands. $8.1 billion is a milestone, not an endpoint. The growth curve is fueled as much by human perception, design integration, and application diversity as by raw technology.

The Takeaway

The LED display market is not just a collection of screens or dollar signs. It is the intersection of design, technology, and human behavior. Scale, resolution, interactivity, and longevity all converge to create surfaces that are simultaneously functional, communicative, and experiential.

When analysts cite $8.1 billion, they are not just measuring hardware sales—they are measuring adoption across industries, adoption that reflects the medium’s ability to transform spaces and capture attention. The market may fluctuate, regions may vary, and technology will evolve. But the trend is clear: LED displays are no longer optional. They are infrastructure. They are tools for designers, communicators, and planners. And they are commanding attention—literally and figuratively—at an unprecedented scale.

The city, the lobby, the arena—they all want a piece of it. And for now, the market keeps growing.